Broad adoption of LEIs could save the global banking sector $2-4 billion

The Global Legal Entity Identifier Foundation (GLEIF) has sought the help of McKinsey to report on the global adoption of Legal Entity Identifiers or LEIs. The conclusions of the now-published report show that the banking industry could save between $2-4 billion in client onboarding. They could help the banking industry save between 5-10% globally if more widely adopted. This represents a total figure of around USD 40 billion.

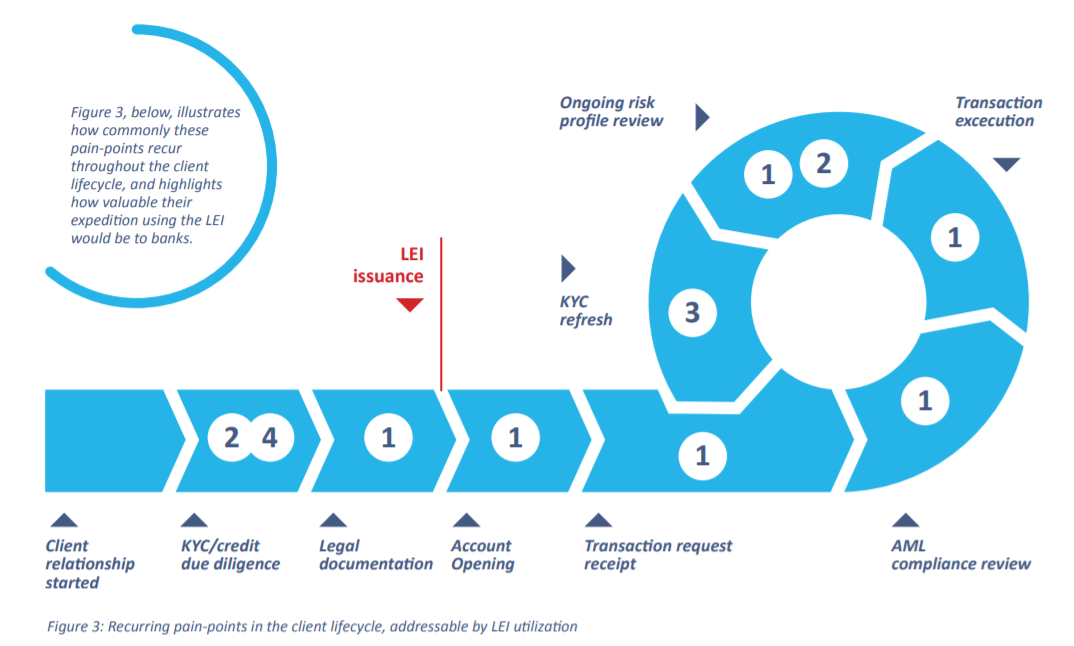

Client onboarding is just one area where LEIs have the potential to help save time and money. Other areas that it could help are in the client lifecycle at transacting, compliance, reporting, risk monitoring, and more.

The figure below provides a list of bank processes that have much to gain from introducing LEIs into client lifecycle management.

Client onboarding and LEIs

McKinsey took client onboarding and created a more in-depth report on the potential savings in this area of client lifecycle management. Today, banks spend around $40 billion on client onboarding annually. By widely adopting LEIs, banks could save £2-4 billion.

This is because banks could reduce onboarding time by using LEIs to streamline the connection between internal and external data sources by 14%. Other benefits include:

- 3-7 days fewer to revenue,

- improved client retention,

- better customer experience (due to fewer requests for data and documents during onboarding),

- and mitigated compliance and credit risks (due to a more holistic view of internal and external data sources).

The broader picture

The report shows that LEIs are mostly used in onboarding but are only ever used at the end of the onboarding process. It recommends that the banking sector do more to move LEIs to the beginning of the onboarding process. This would expedite counterparty identification and verification, increase compliance and improve KYC processes.

Post-onboarding, the LEI could be used with KYC refreshers periodically and additional verification for special payments and ongoing monitoring of counterparties. For example, negative news regarding a counterparty credit or business activity.

Four pain points were identified in the 50 interviews conducted with central banks.

- Manual linking of entity data from disparate internal and external sources.

- Difficulty in assessing entities’ legal ownership structure.

- Limited transparency into entities’ key officers.

- Poor customer experience due to having to make multiple round trips to gather client data and documents.

The report itself says:

“The study found that many banks try to resolve these problems by implementing various technical solutions, increasing headcount, or just accepting longer cycle times. Since none of these methods fully resolves any of these pain points, many banking interviewees responded enthusiastically to the idea of using LEIs to identify and verify counterparties.”

The report concludes by suggesting that the banking sector should

“participate in the ensuing discussion on the support needed for banks to integrate the LEI into CLM processes. GLEIF also welcomes the opportunity for dialogue with banking associations, alliances and broader stakeholders on this matter and will be pursuing collaboration initiatives on a global scale.”